Is Your Bank’s Card Program a Money-Making Machine? It Should Be.

Is Your Bank’s Card Program a Money-Making Machine? It Should Be.

Joe Warner

Fintech Sales Manager, DCI

In today’s financial landscape, optimizing your community bank’s card program isn’t just about offering convenience to customers; it’s about transforming it into a bona fide stream of revenue for your institution. To do this is to master the art of interchange.

The Power of Interchange

Interchange, in its simplest form, is the fee paid between banks and other financial institutions for facilitating card transactions. It’s the engine that powers your card program’s revenue. As such, understanding interchange through the lens of BaaS/Fintech processing is crucial.

Community bankers know better than most that anything that benefits banking customers also benefits the bank itself, and card programs are no different. Offering enhanced customer engagement and security, they are also a significant source of profit when managed wisely.

What Banks Need to Know

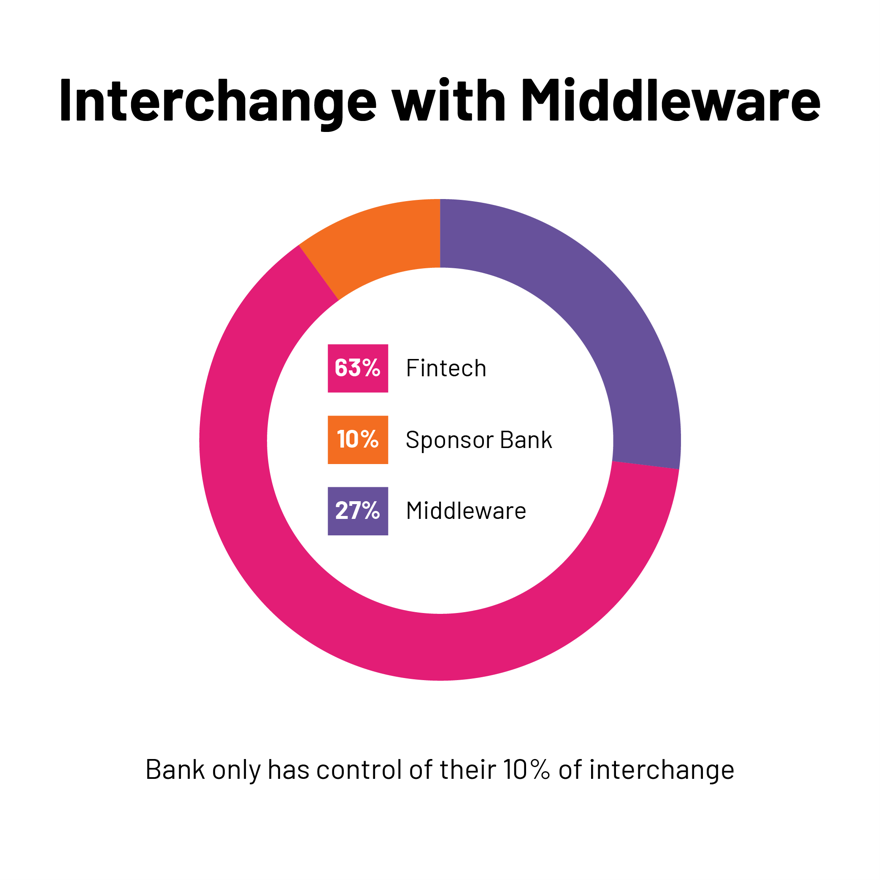

In today’s age, every percentage point of that net interchange counts. Where middleware is involved, money comes out of the bank’s (or Fintech’s) pocket. In that case, always be vigilant about the share that middleware is taking. If your institution seeks greater control over how much interchange is shared and where it is allocated, consider whether the involvement of middleware is the best path forward.

- Net Number

Behind the scenes of your card program, one essential figure requires utmost focus—the net. Often, the following entities will each take their share of the raw interchange:

- The card network

- The middleware component

- The card processor

- The partner bank

The number left for your bank at the end of this process is the net interchange—thus, the fewer parties involved, the higher your net revenue.

- Published Fees/Rates a Must

When it comes to network selection, transparency is key. Opt for networks that publish their fees and rates. If your current network doesn’t, don’t hesitate to advocate for regularly scheduled, published fees.

- Pay Attention to the Amount the Middleware is Taking

In today’s age, every percentage point of that net interchange counts. Where middleware is involved, money comes out of the bank’s (or Fintech’s) pocket. In that case, always be vigilant about the share that middleware is taking. If your institution seeks greater control over how much interchange is shared and where it is allocated, consider whether the involvement of middleware is the best path forward.

Card Programs of Choice

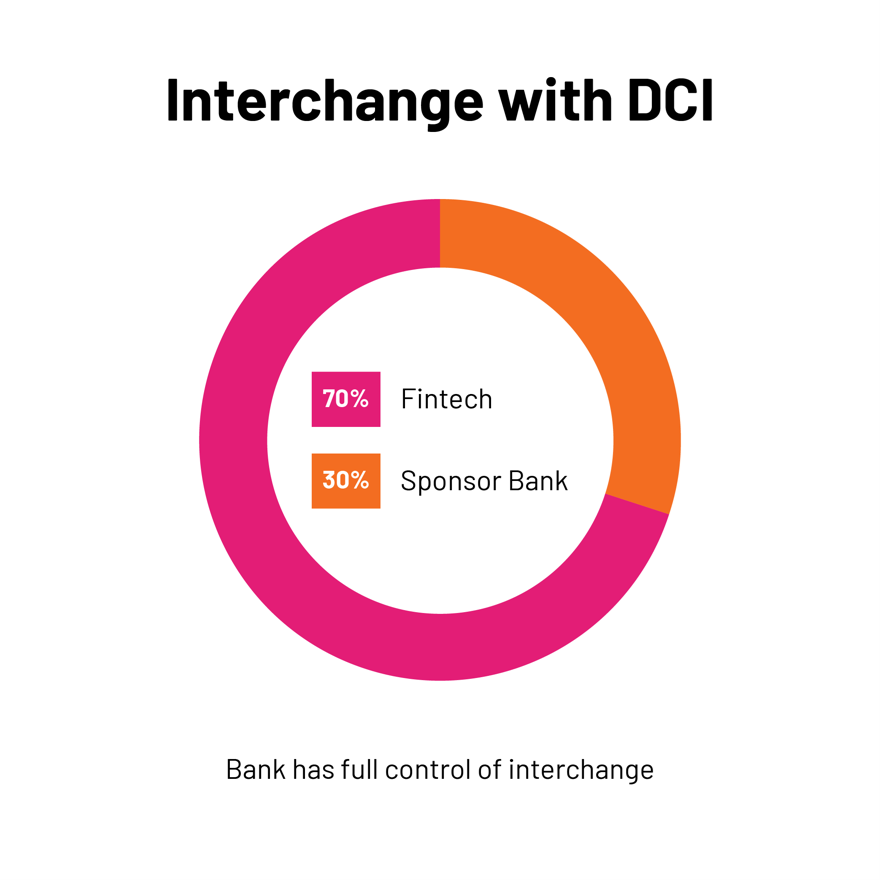

For the purpose of increasing the net number discussed above, it’s optimal to select a card program absent of middleware—especially where a Fintech is involved. For a look at the average net percentages where Middleware is present, see the chart below:

Source: 2023 Internal Data Review, DCI

Source: 2023 Internal Data Review, DCI

A 27% share of the raw interchange is no small amount. Clearly, with middleware eliminated, your bank’s net revenue skyrockets. But is such a profitable card program for banks too good to be true?

Tanna Faulkner, SVP of Sales and Digital Channels at DCI, says it isn’t. She shares, “It’s not uncommon for DCI customers to make money on card programs. Not only do we operate without the need for middleware, but we also have our own fee for banks, and mark-ups aren’t a part of it. With us, banks get 100% of their interchange income.”

Conclusion: Interchange as a Powerful Tool for Card Program Profitability

The benefits of an optimized card program go beyond payment solutions for satisfied customers—it’s also a powerful means of generating lucrative assets. As such, when selecting a card program, keep in mind:

- The net interchange

- Transparency from networks

- The role of middleware

For a profitable card program that benefits your bank and customers alike, start by understanding interchange, choosing networks wisely, and partnering with a processing solution that puts your institution’s interests first.

It’s time to turn your card program into the money-making machine it should be.